A Business Activity Statement (BAS) is a statement that needs to be lodged with the Australian Taxation Office (ATO) on an annual, monthly or quarterly period. The frequency will be set by the ATO. Your business size will determine the frequency of lodgement.

The GST was first introduced in 2000 and replaced a range of state and federal taxes. The GST is paid by customers who purchase goods or services. Registered business must legally collect and pay out the difference in GST and well as other tax obligations.

Your business structure will vary the requirements for lodging your BAS. Being a sole trader, company, partnership or trust will affect the tax you’re liable to pay, asset protection and running costs. As your business grows, your business structure may change to suit. If you’re not sure if your current business structure best suits your business, an accountant can advise you on your best choices.

What do I need to report in my BAS?

In a BAS statement, you’ll need to report on your businesses:

- Goods and Services Tax (GST)

- Pay As You Go (PAYG) Instalments

- PAYG withholding tax

- Fringe Benefits Tax (FBT)

- Luxury Car Tax (LCT)

- Wine equalisation tax (WET)

- Fuel Tax Credits

CLICK HERE TO MAKE AN APPOINTMENT WITH AN ITP BOOKKEEPER

When do you need to lodge a BAS statement?

HOW

The due date for lodging your BAS will be shown on your BAS form. If the date falls on a public holiday or weekend, you’ll be able to lodge on the next working day. The ATO will send you the statement when it is due.

The frequency of lodging your BAS statement will depend on the gross income of your business:

- Quarterly – if your GST turnover is less than $20 million – and the ATO has not told you that you must report monthly.

- Monthly – if your GST turnover is $20 million or more.

- Annually – if you are voluntarily registered for GST and your GST turnover is under $75,000 ($150,000 for not-for-profit bodies).

Quarterly reporting

Dates are set throughout the year to lodge your BAS.

| Quarter | Due date |

| 1. July, August and September | 28 October |

| 2. October, November and December | 28 February |

| 3. January, February and March | 28 April |

| 4. April, May and June | 28 July |

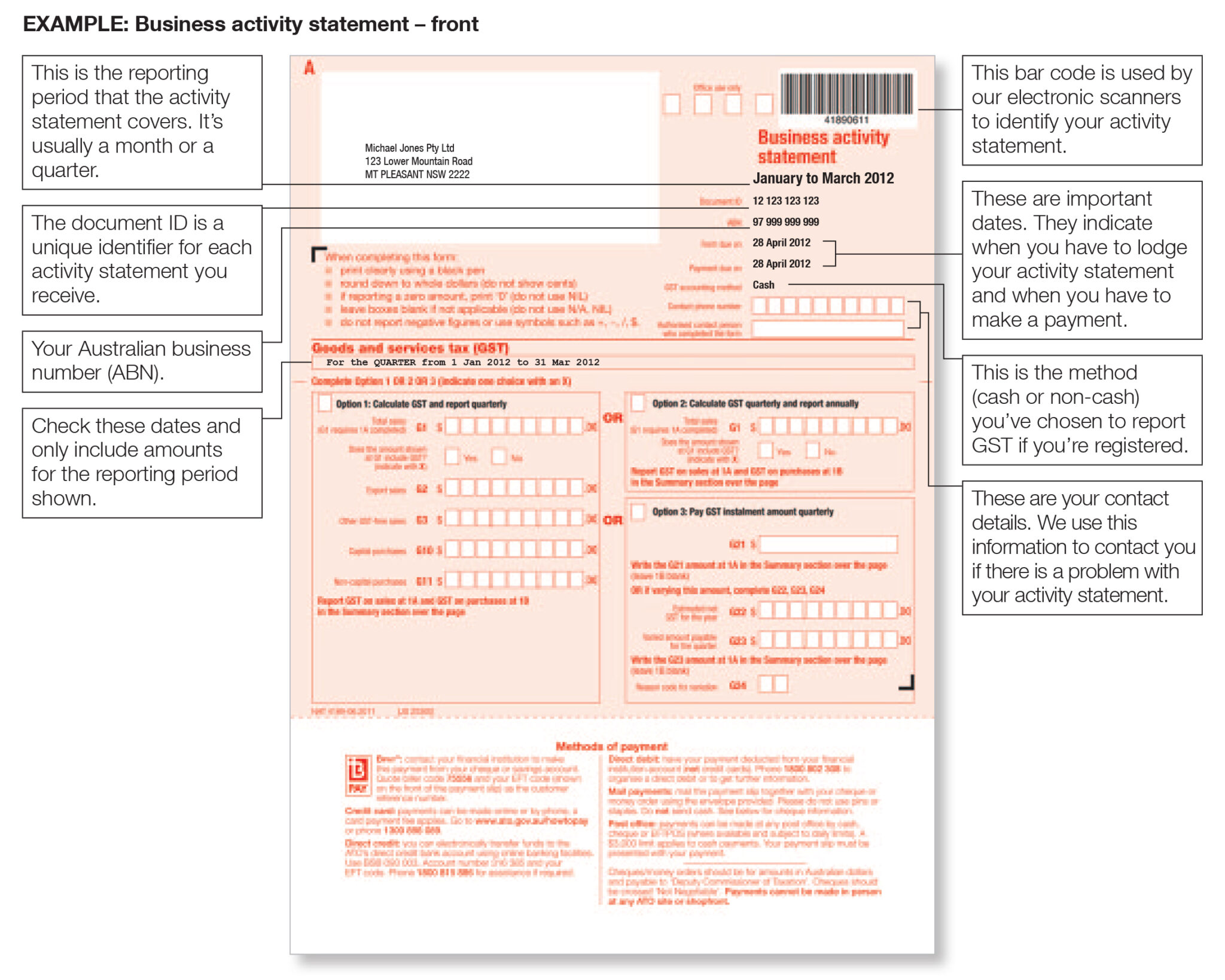

BAS example

Your BAS statement will be slightly different depending on your business structure.

Example: Business activity statement – front

To make sure the ATO scans your activity statement correctly, you should:

- print clearly using a black pen

- leave boxes blank if they don’t apply to you, unless the ATO have asked you to write ‘0’ (do not use NIL)

- show whole dollars only (round cents down to the nearest whole dollar)

- don’t report negative figures or use symbols such as +, -, /, $

- don’t write any additional information on your activity statement – contact your accountant or bookkeeper if your details have changed.

Example: Business activity statement – rear

Download this article: How do you fill out a Business Activity Statement

Pro tax tip: Categorise your business invoices

Staying on top of your bookkeeping is key to preparing your BAS. By categorising your business invoices and receipts will save time and effort. Accounting software can make this process quick and easy.

It’s good practise to keep up-to-date information of your invoicing and expenses. These records should include the date, type of transaction, description and GST (if applicable). When your BAS is due, you’ll need to total these records, complete the BAS form and lodge it to the ATO. Records should be kept for at least five years.

You can lodge your BAS online or through a registered tax agent. If you have an accountant or bookkeeper, this is a huge task they can take care for you easily and accurately and will free up your time to work on your business and not just on your books.

CLICK HERE TO MAKE AN APPOINTMENT WITH AN ITP TAX ACCOUNTANT

Taking care of business

ITP The Income Tax Professionals help businesses around Australia with their tax and accounting requirements. With over 240 locations, there’s sure to be a branch near you. If one isn’t close by, ITP have a remote service and can help you wherever you are in Australia. Call a professional today and see how they can help you.