Running a small business isn’t just about selling your product or service, or even finding new markets of customers to expand your offering. Many things come into play. Before you make any move, you need to understand the financial position of your business. The balance sheet is an invaluable piece of information. You should know how to create, read and interpret this key information for your small business.

What Is A Balance Sheet?

Your balance sheet gives you an insight into your business and its operations. Here, you can see your businesses liabilities, assets and owners net-worth equity at a glance. A balance sheet is used to make informed decisions by looking at:

- The businesses current financial position

- The businesses profits and losses

- What your business is worth in total

The balance sheet is a key decision making tool and is usually prepared at the end of set period, such as end-of-month, quarterly, or annually.

What Information Goes Into A Balance Sheet

Several key pieces of information should be included in your balance sheet. Assets and liabilities are included as well as profits and losses, including:

- Assets – real estate, vehicles, office equipment

- Expected revenue – accounts receivable

- Expected expenses – accounts payable

CHAT WITH A FRIENDLY BUSINESS ITP TAX ACCOUNTANT TODAY

Why Is A Balance Sheet Important?

Other than using the balance sheet as a decision-making tool, it will also help with tax deductions. You’ll need to know what assets your business owns and the rate of depreciation on each asset. Deferred tax liabilities and current tax liabilities need to be included in the balance sheet.

Pro Tax Tip: Don’t forget to keep all of your receipts when claiming your tax deductions. Without proof, the Australian Taxation Office (ATO) will decline your claims.

You’ll need to produce a balance sheet if you want to sell your business or change your business structure into a company, or seek investments.

It’s important to note that assets and liabilities will differ from business to business.

What Information Is Included In A Balance Sheet?

A balance sheet is divided into two parts. The first part is the businesses assets and liabilities, and shareholder equity if required. Assets can be physical or intangible items that can be the means in which you use to cover the businesses financial obligations, such as investments and retained earnings.

Assets – there are two types of assets known as current and non-current assets. Noncurrent assets are those items that cannot be liquidated within a year and have a longer life span compared to other assets. These are items such as machinery, computers, real estate, land. Non tangible non-current assets include patents, goodwill, copyrights and determine if a product makes it to market. Most assets of businesses are financed through borrowing. Assets may include accounts receivable, inventory and prepaid expenses.

Liabilities – are business financial obligations to other entities and are categorised as current and non-current liabilities. Non-current liabilities are such items as long-term debts and non-debt financial obligations due after a period of more than one year. Current liabilities must be paid within one year and include borrowings, account payables or monthly interest payable on loans. Liabilities include pension plan obligations, interest on loans and bonds payable.

Shareholders equity – is the original amount of money invested in a business. Retained earnings are taken from the income statement and put into the balance sheet and form your businesses net worth. This shows what is left in your business if all liabilities were paid off. This is what you have invested in your business.

Pro Tax Tip: Sole traders would show their investment as owners equity, which might be cash and/or property minus withdrawals. A company would represent owners equity as shareholders equity and includes company shares and retained earnings.

Assets and liabilities are put into two columns. The assets sit on the left and the liabilities are on the right, as well as owners equity. The total of the liabilities and the owner’s equity equals the assets.

How To Create A Balance Sheet

The following equation forms the basis of a balance sheet:

Assets = Liabilities + Owners equity

The value of total assets should be equal to the total amount of liabilities and owner’s equity. The balance sheet should be dated to determine when the financial year ends – month by month, or financial year. You should ensure your balance sheet has a title which should appear at the top.

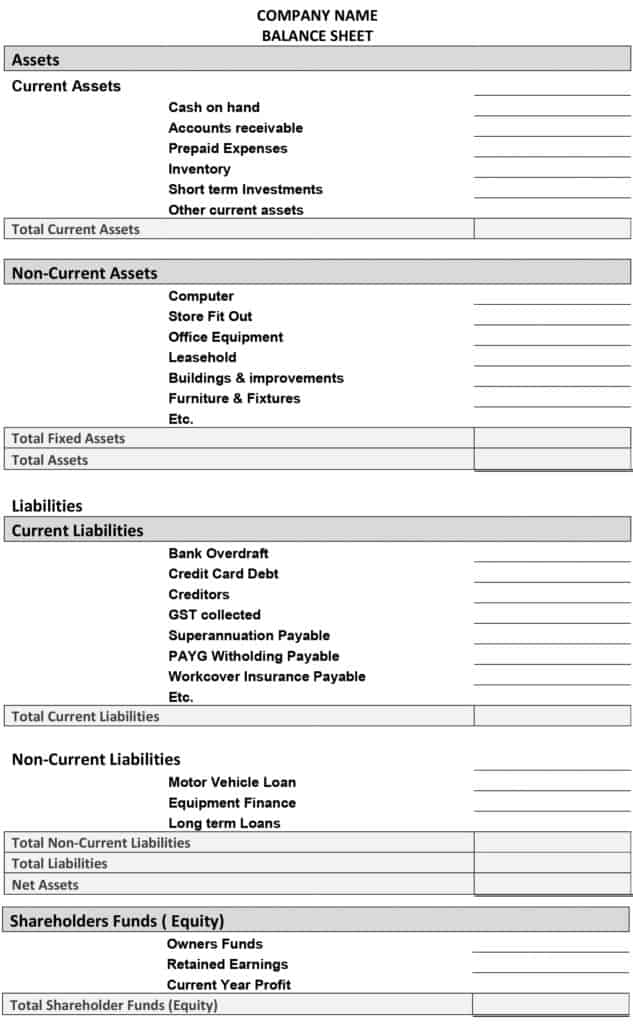

Sample Balance Sheet.

Note the items listed are not exhaustive and will differ from business to business.

Incorporated businesses should include balance sheets, income statements and cash flow statements in financial reports for stakeholders and shareholders, tax and other regulatory authorities.

The balance sheet is an important tool for assessing and monitoring the financial health of your business. Most small to medium sized businesses will need a balance sheet prepared. An ITP Accounting Professional can create a balance sheet as well as interpret the information and provide guidance. ITP Accounting Professionals help Australian small to medium businesses for 50+ years. There’s not a lot they don’t know about business finance and tax. Phone 1800 367 487 and chat with a friendly professional today.