Providing your employees with Fringe Benefits is a great way to let your staff know that you recognise and appreciate their contributions towards your business, but you have to understand, it’s not just a giveaway. Any extra benefits or perks you provide to your employee is seen as a part of their wage or salary and is deemed taxable income in the eyes of the Australian Taxation Office (ATO).

Fringe Benefits Tax (FBT) is a tax you pay as an employer on certain benefits or perks that you provide to your employees. FBT might even apply to a third party under an arrangement with the employer. FBT is a tax on income but the trick is working out the taxable value and reporting it correctly.

Types Of Fringe Benefits:

There are a number of non-cash benefits that you may provide to your employees:

- Private use of a company car

- Low interest rates of a loan used for private purposes

- Payments you might make on behalf of your employee

- Entertainment, such as meals, accommodation, tickets to sporting events

- Training or sick leave

CHAT WITH A FRIENDLY ITP TAX ACCOUNTANT TODAY

Calculating Fringe Benefits Tax

The Fringe Benefits year work differently to the calendar or financial year. The FBT year is the 12 months beginning 1 April and ending 31 March. You’ll need to be aware of the current rates and thresholds as they may vary from year to year.

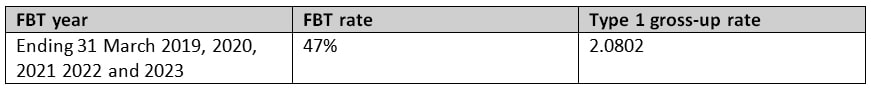

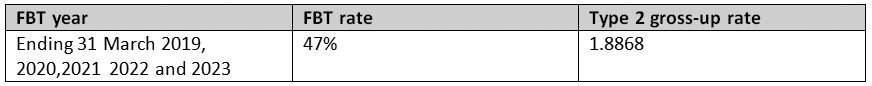

There are some steps involved when calculating your FBT liability. With the introduction of the GST, there are two separate grossed-up rates used to calculate fringe benefits taxable amounts – a high (type 1) and a lower (type 2) gross-up rate.

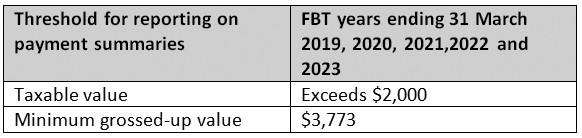

If you provide benefits with a total taxable amount of more than $2,000 during the FBT year, you are obligated to report the grossed-up taxable value of the fringe benefits of your employee payment summary or through Single Touch Payroll (STP).

Type 1: Higher Gross-Up Rate

The Type 1 gross-up rate

Type 2: Lower Gross-Up Rate

This rate is used if the benefits provider is not entitled to claimed GST credits

The reportable fringe benefits taxable amount is calculated by ‘grossing-up;’ the benefits amount to a tax-inclusive amount. This is done to ensure that the benefits are equal to the employee’s current wage or salary.

The taxable amount is calculated by diving the aggregate benefits by (1 – 47% (or 49% of 2017)). The 47% is regarded as the highest marginal tax rate plus the Medicare levy.

Reportable Fringe Benefits Thresholds

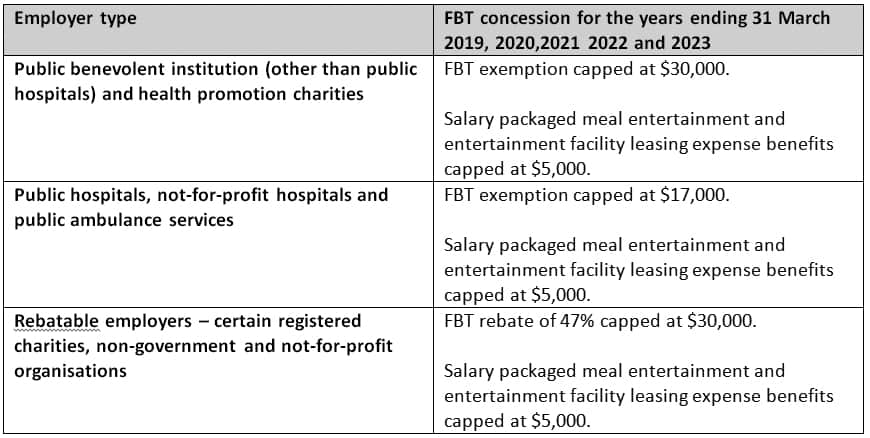

FBT treatment for certain employers

The capping thresholds for the FBT exemption and FBT rebate concessions are shown below.

GST And FBT

A GST amount of 10% applies to most goods and services and will affect the calculation of your FBT liability. You should use the higher grossed-up value to calculate your FBT liability where you or other providers claim GST credits. Where there is no GST to be paid or claimed, the lower gross-up rate applies.

If your employee makes a contribution towards the cost of the fringe benefits, then this considered a taxable sale for GST purposes.

Steps:

- Calculate the pre-grossed up value of the benefits paid to employees

- Identify the total taxable benefits you provide for which you can claim a GST credit (type 1)

- Calculate the grossed-up value of the Type 1 benefits by multiplying the total taxable value by the Type 1 gross-up rate

- Identify the total taxable value of benefits for which you cannot claim a GST credit (Type 2)

- Calculate the grossed-up taxable value of these Type 2 benefits by multiplying the total taxable by the type 2 gross-up rate

- Add the amounts together

- Multiply the total fringe benefits taxable amount by the FBT rate and this will give you the total FBT amount you are obligated to pay

You’ll need to report your FBT at the end of the FBT year. You will need to pay your FBT when you lodge your BAS annually or quarterly, and must be paid before the FBT due date to avoid interest fees and penalties. You must register with the ATO when you need to pay FBT to your employees. You will need to complete an Application To Register For Fringe Benefits Tax and send it to the ATO. Calculating the correct FBT is complex.

ITP Accounting Professionals can calculate and handle this process for you so that no mistakes are made. ITP Accounting Tax Professionals have been helping Australian individuals and business with their tax for 50+ years. Phone a friendly professional today to chat about your FBT obligations and how to reduce your businesses overall tax bill. Phone 1800 367 487 today.