In order to claim GST, first of all, your business will need to be registered for GST. GST-registered businesses can claim back the GST they pay on business expenses. And in some cases, you can claim back GST that you’ve already paid to the ATO.

You can claim GST back when

- you’ve purchased goods or services for your business (these are called input tax credits)

- a customer leaves you with a bad debt

When you make a GST claim it’s called an input tax credit, or a GST credit. You claim GST credits through lodging your Business Activity Statement (BAS).

You can only claim GST credits when:

- You intend to use your purchase solely or partly for your business

- The purchase does not relate to making input-taxed supplies

- The purchase price included GST

- You provide or are liable to provide payment for the item you purchased

- You have a tax invoice from your supplier (for purchases more than A$82.50).

When you claim GST credits, you need to make sure that your suppliers are registered for GST. If you’re in doubt, you can check the suppliers’ status by searching the ABN Lookups website.

You can also check with your tax or BAS agent, accountant or bookkeeper. A four-year time limit applies for claiming GST credits.

NEED SOME HELP? ITP OFFER BOOKKEEPING SERVICE TAILORED TO SUIT YOUR BUSINESS.

When am I not able to claim a GST credit?

You cannot claim a GST credit:

- When you don’t have a valid tax invoice

- If you’ve made purchases that do not have GST in the price

- On wages you pay to your staff (there is no GST on wages)

- If you have any motor vehicles priced above a certain limit.

Goods and services that don’t have GST in their price include:

- GST-free items (such as basic foods)

- Input-taxed items (such as bank fees and loan interest)

- Purchases from a business that is not registered for GST or required to be registered for GST (as GST isn’t included in the price).

You also cannot claim GST credits for the following, even if GST is included in the price:

- Private or domestic goods or services

- Input-taxed supplies

- Supplies associated with residential accommodation

- Personal entertainment expenses

- Land purchases under the margin scheme.

Pro Tax Tip: Keep your tax invoices

- Make sure to keep records of all sales, fees, expenses, wages and other business costs

- Keep appropriate records, such as stocktake records and log books to substantiate motor vehicle claims

- Reconcile sales with bank statements

- Use the correct GST accounting method

- Keep all your tax invoices and other GST records for five years

You’ll need to keep tax invoices you’ve received as businesses expenses. You must have a tax invoice to claim a GST credit for purchases that cost more than A$82.50 (including GST).

Download this article: How do you claim GST credits on your BAS form

What happens if I don’t have a tax invoice?

If you haven’t received a tax invoice, your supplier has 28 days to give you a tax invoice after the request.

When you receive an invoice it’s best to check to see that it is an official tax invoice and that the GST component has been stated. You can ask your supplier to issue an invoice with the correct information.

To claim a GST credit for purchases that cost A$82.50 or less (including GST), you should have one of the following:

- a tax invoice

- a cash register docket

- a receipt

- an invoice.

If you can’t get one of these, keep a record of the purchase, such as a diary entry with:

- the name and ABN of the supplier

- the date of purchase

- a description of the items purchased

- the amount paid.

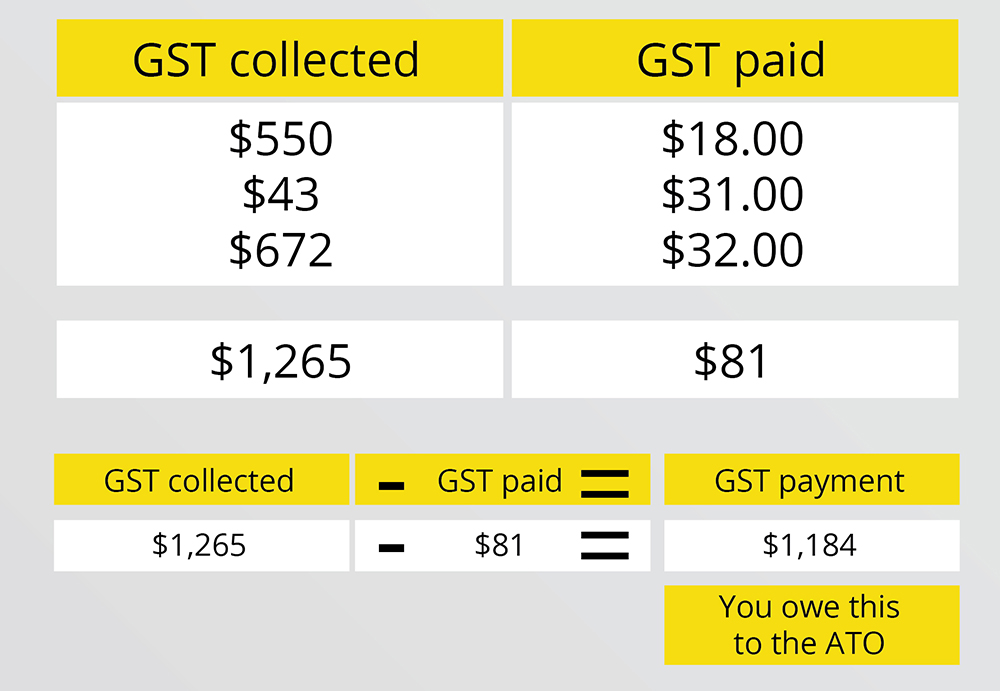

How to work out GST payable

You’ll need to calculate the difference between what you have collected from your customers and what you have paid for your business expenses.

- Calculate and add the GST you have collected on your tax invoice

- Calculate and add the GST you have paid on your tax invoices

- Subtract the GST collected to the GST paid.

To calculate everything you’re entitled to claim, it pays to keep up-to-date with your bookkeeping and to make sure you have saved all of your tax receipts as the ATO might request proof at any time.

Pro Tax Tip: Set the GST money aside into a separate business account. That way, when the time comes to make your payment, you won’t be caught short.

It doesn’t have to be confusing. If figures aren’t your strong suit, or if you don’t have the time to reconcile your books, it might pay to hire a bookkeeper or accountant for your business.

Taking care of business

ITP The Income Tax Professionals help businesses around Australia with their tax and accounting requirements. With over 210 locations, there’s sure to be a branch near you. If one isn’t close by, ITP have a remote service and can help you wherever you are in Australia. Call a professional today and see how they can help you.