Most people hate tax time. We understand! Time is precious. Not only do you have to pay tax during the year, but then the government expects you to spend hours going through your expenses to make sure you’ve paid enough. Then, if you want to claim anything back and minimise the tax you’ve paid, you need to make an appointment with a tax agent and spend time you don’t have going through your expenses and working out the work-related costs you don’t really know if you can claim or not.

It’s tedious.

That’s bad enough, but what if you haven’t calculated your expenses properly. There have probably been times in the past when you’ve done just that. It was a risk you were willing to take…but what happens if the ATO tracks you down. Is the risk worth it?

Probably not.

It’s tempting to DIY – but tax time only comes around once a year. Are you really reducing your tax bill? The ATO isn’t set up to minimise tax. Quite the opposite, in fact.

Tax is complicated.

Even if you do understand how to claim all of your expenses, have a working knowing of depreciation, instant capital write off and capital gains tax, the truth of the matter is that tax laws often change, and if you’re not in the know – you don’t know.

Now, now. Don’t hide. That’s the worst thing you can do.

Trying to understand the forms on your DIY tax return is a bit like dropping through the looking glass. You do not want to make a mistake by filling out the wrong figure in the wrong place.

Tax gets complicated, especially if you run a small business, have a side hustle or investment property, but even if you’ve only got the one day job, pay your tax and other obligations during the year, you’ll still need to be aware of ways you can maximise your tax return. There’s no such thing as a simple, run of the mill tax return. Everyone’s circumstances are unique.You have to be sure you’re getting the most tax back with the biggest refund for the smallest amount of time and effort.

There must be an easy way – right?

Well, yes. ITP’s express online tax return is as easy as it can get. If you can answer questions, such as ‘how much income did you earn in 2019/20 and ‘do you own your house?’ you’ll be a happy camper.

The questions have been designed to lead you through your credits and the deductions you qualify for and will calculate how much money you need to pay or will get back. While there is a cost, the process is so much easier than doing it all yourself. The fees are also 100% tax deductible on your next year’s tax return.

It gets even better.

Once your information is filled out, an ITP Tax Accountant will manually go through your figures, work out if there are more claims you could make and get in touch with you if there is. All without having to get off the couch. No appointment necessary. You can even start at midnight if that suits you.

If you get half way through, and the your calculations are is way bigger or way smaller than you anticipate, you can go back and make sure you’ve got the right numbers in – and if you can’t figure it out, an ITP Tax Accountant will help. You’ll be able to complete your tax return over a phone appointment. That way, you’ll know for sure you’re getting everything right.Now you know the simplest and easiest way to fill out your tax return, it’s time to get started. Simply log on here at www.itp.com.au:

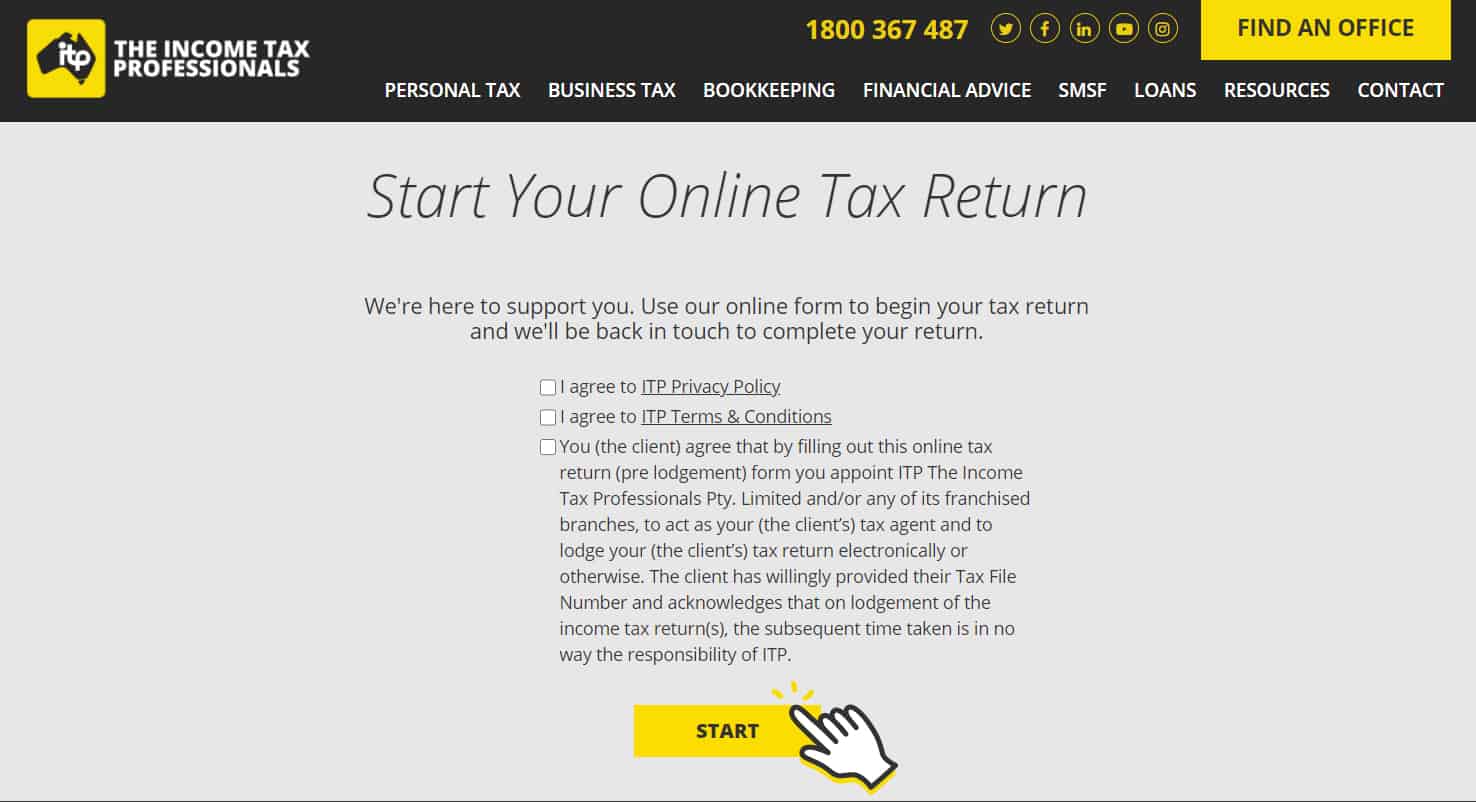

Tick your boxes:

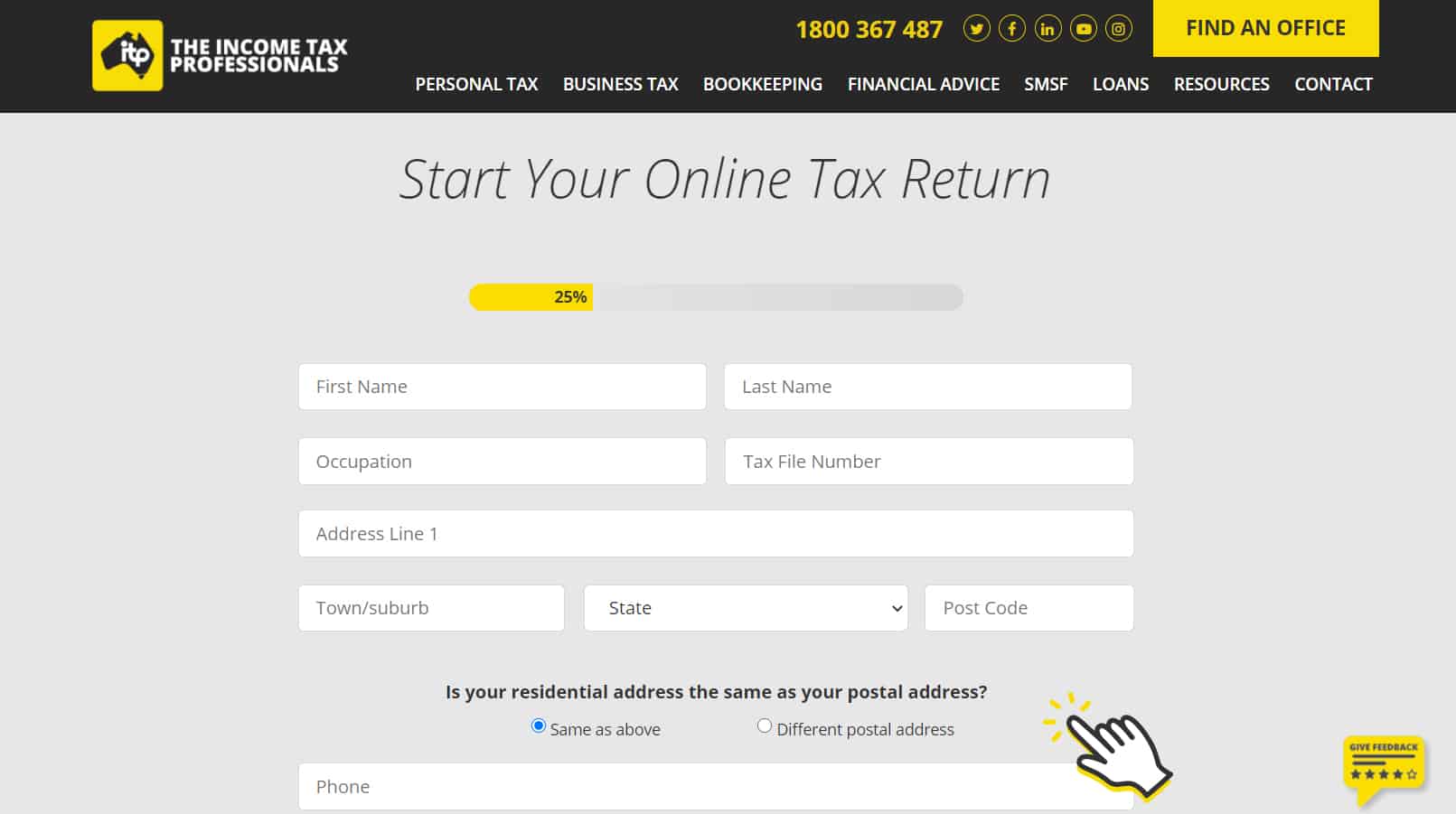

Fill out your information and off you go. See, you’re already 25% of the way through:

Before you start, make sure you have all of your information. It’s all about preparation; after all, you don’t want to be sitting in front of your computer longer than you have to.

- Make sure you have all of your income statements. It pays to wait a couple of days after the 30 June deadline to make sure all of your EOFY information has come in. This includes:

- payment summaries

- bank statements

- private health care statements

- investment shares of dividends

- details of expenses from investment properties

- foreign income or pensions

- Your tax file number

- Your bank details

- Your Medicare statements

- Any Centrelink payments

If you plan to claim more than $300 in work-related expenses you’re also going to need:

- Copies of invoices or receipts, which can be paper or electronic

- Credit card statements

- Travel logbook

- Home office logbook

It pays to stay on top of your expenses. Use an app to records your receipts. Not only will it save you hours at the end of financial year, but it will save you hours when you go to loge your tax return. The ATO allows electronic copes of receipts as long as they’re a clear and true representation of the original. Don’t forget to back up your files. You’ll need to keep them for five years.

Remember, the responsibility ultimately rests with you.

It’s important to understand that you’re responsible for making sure your deductions are legitimate. There’s a reason you need to sign off everything when you file for your tax return.

What if it’s all too hard?

Don’t stress. An ITP Tax Accountant will lead you through the entire process and will ask you question to make sure you’re claiming everything you can. There’s a reason 74% of Australian choose to use a Tax Accountant and it’s easy to understand why. Every profession and claims are different and unless you’re up to date with the latest tax information, it’s easy that claims you may be entitled, slip through.

There’s no need to hate tax.

We’ve been helping Australian individual and businesses with their tax for 50+ years. So you can put your feet up and know that you’re getting the best tax return you can get. Don’t pay more tax than you have to!

An ITP Tax Accountant can amend your details even if you’ve lodged your tax return and didn’t expect the results you thought you were going to get. An ITP Tax Agent will be able to advise what you can claim and help you maximise your tax return.

Whilst taking every precaution to stay safe, our Tax Accountants are available during normal business hours to help with any enquiry. Speak with a Professional and see how they can help you today.

Call 1800 367 487, or book online at www.itp.com.au and your tax agent will be in touch to help.