September 28, 2020 marks the extension time for the next phase of the JobKeeper payment scheme, known as JobKeeper 2.0. Two extension periods are now planned and involves changes to both employer and employee eligibility.

The two extension periods are:

- Jobkeeper extension 1: 28 September 2020 to 3 January 2021

- Jobkeeper extension 2: 4 January 2021 to 28 March 2021

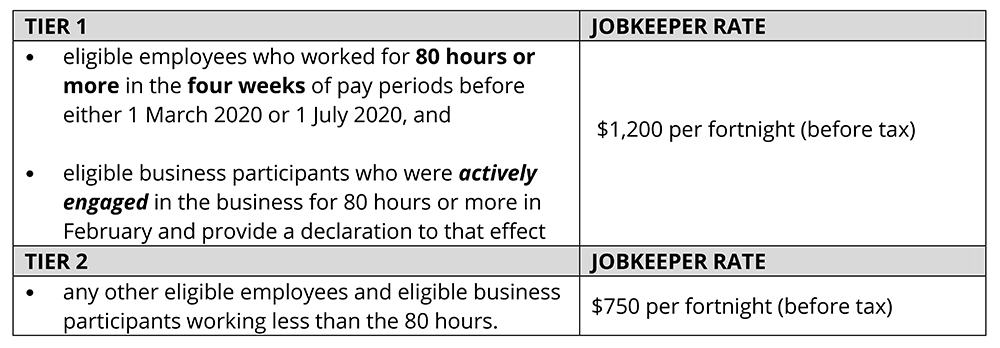

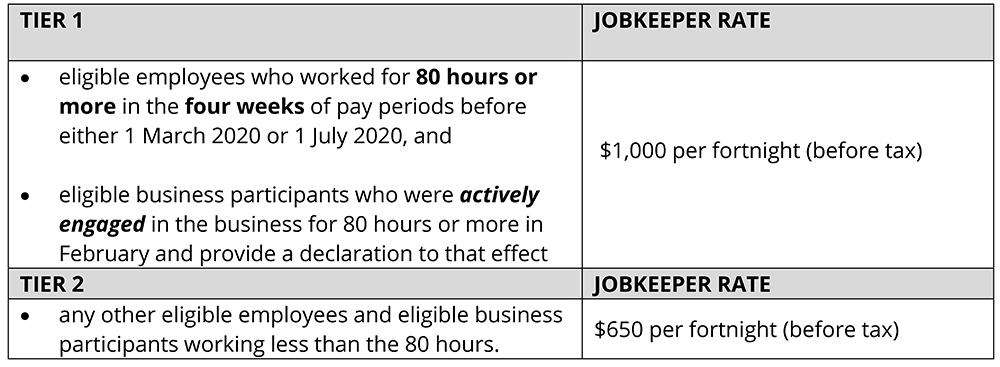

The amount of the JobKeeper payment in each extension period will depend on the number of hours an eligible employee worked, or an eligible business participant was actively engaged in the business in the four weeks of pay periods before either 1 March 2020 or 1 July 2020.. The two payment rates are referred to as tier 1 and tier 2 payments. The rate of the JobKeeper payment is different for each extension period.

Under the original JobKeeper, the rules in turnover could be based on a single monthly decline that related to the corresponding month of the previous year. For example, the decline in September 2019 compared to September 2020. The new rules for JobKeeper 2.0 require a decline in the 2019 September and December quarters to the 2020 September and December quarters.

To calculate the fall in turnover for JobKeeper 2.0, the same accounting method used for GST reporting must be used. Depending on your circumstances, this could be a cash or accruals basis. You’ll also need to complete a monthly business declaration. Businesses that are not registered for GST will assess their fall in turnover based on the actual gross income using either the cash of accrual accounting method. Alternative tests are available.

JobKeeper Extension 1: 28 September 2020 to 3 January 2021

To be eligible for the Tier 1 payment of JobKeeper 2.0, your business (including not-for-profits) with a business turnover of $1 billion or less must show a decline in GST turnover of 30% or more based on the actual turnover for the September 2020 quarter compared to the September 2019 quarter.

If your business is $1 billion or more, you’ll need to show a decline of 50% GST turnover in the September 2019 / 2020 quarters.

An ACNC-registers charity must show a 15% decline in GST turnover. Your business must not be subject to the Major Bank Levy, Australia Government Agency, Sovereign entity or a company in liquidation. Legacy employees qualify for JobKeeper 2.0 and must satisfy a different set of eligibility criteria.

All businesses must also meet the eligibility criteria from JobKeeper 1.0. If your BAS from September 2019 has not been lodged, you’ll be unable to apply.

If you’re applying for the first time from 28 September 2020, your business must satisfy the actual decline in turnover test which can be done through a registered tax agent. To apply, you must have lodged your September 2019 BAS.

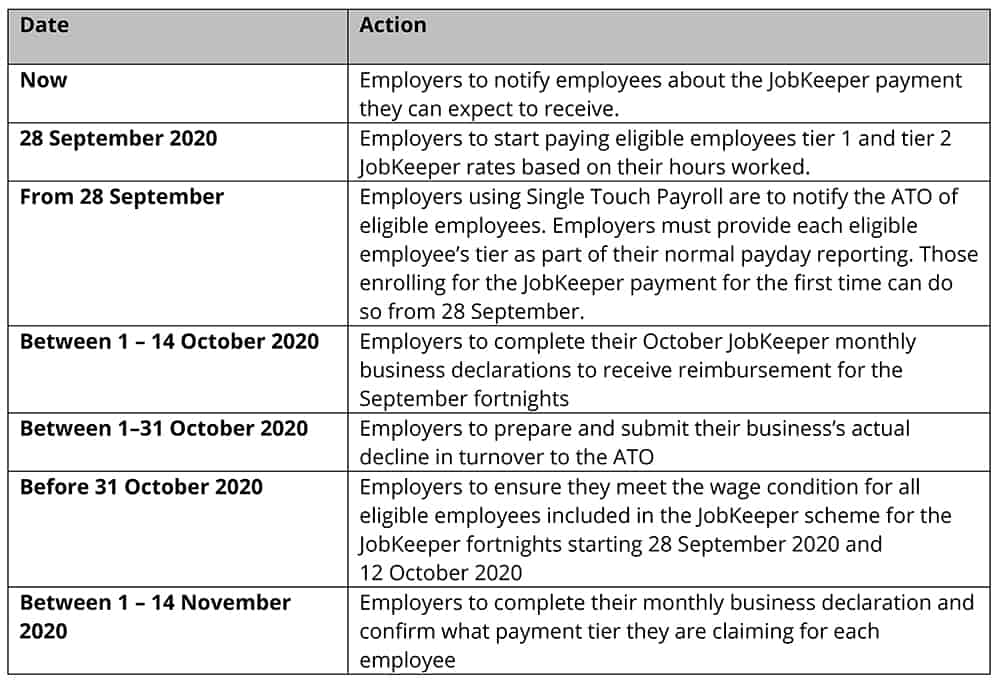

You have until 31 October 2020 to meet the wage condition for fortnights ending in October for all your eligible employees.

The JobKeeper payment rates are based on actual hours worked in a 28 day period and will be offered under two tiers:

Download this article: JobKeeper 2.0

There are different options for the 28-day reference period that you must use to test whether an employee satisfies the 80-hour threshold.

A sole trader must actively perform and manage the business and sales of the goods and services, must perform other activities required of the business, manage strategy, growth, planning, budgets, record keeping, accounts and tax.

Record Keeping

To be eligible to apply, you must have kept records to prove your eligibility. Records can include:

- business diaries

- appointment books

- log books

- hours billed

- invoices issued

- time sheets or attendance records

- records prepared for other business or statutory purposes

JobKeeper Extension 2: 4 January 2021 to 28 March 2021

The eligibility criteria for JobKeeper extension 1 and 2 are essentially the same except that in order to claim the JobKeeper extension 2 the business will need to show that their actual GST turnover has fallen by the specified shortfall percentage (30%, 50% or 15%) for the December 2020 quarter compared to the December quarter in 2019.

A business can be eligible for JobKeeper extension 2 even if they were not eligible for JobKeeper extension 1. Your December 2019 BAS must be lodged. Un-lodged BAS statements may hold up the JobKeeper application process.

The rates of the JobKeeper payment in this extension period are:

Key JobKeeper dates

If your business was on the original JobKeeper scheme and no longer passed the decline in turnover test, you should notify your eligible employees and/or eligible business participant that you are unable to claim JobKeeper payments for them.

You should also advise them that you are no longer obligated to pay them an amount that is at least equal to the JobKeeper payment in those fortnights.

If your business is not eligible in extension 1 but requalifies for extension 2, you do not have to re-enrol for JobKeeper. Simply declare their eligible employees and business participants on the monthly business declaration to the ATO.

ITP Tax Accountants are fully versed with the JobKeeeper changes and can help you apply for the JobKeeper scheme even if you haven’t qualified before. They can apply for JobKeeper on your behalf and understand what is required so that you are not held up in the process.

Whilst taking every precaution to stay safe, our Tax Accountants are available during normal business hours to help with any enquiry. Speak with a Professional and see how they can help you today.

Call 1800 367 487, or book online at www.itp.com.au and your tax agent will be in touch to help.