The Federal Government has just handed down their new budget to help the Australian economy get back on its feet. The Government’s initial response to the COVID-19 pandemic provided $299 billion in overall support through the JobKeeper payment scheme, boosting cash flow for employers and Corona virus supplements for those on income support.

The 2020-21 Budget commits further response and recovery support, bringing the Government’s overall support to $507 billion, including $257 billion in direct economic support. The Federal government seeks to boost household income, support businesses, drive infrastructure developments, increase economic resilience and create a more competitive and income-generating economy.

Budget At A Glance

Lower Taxes

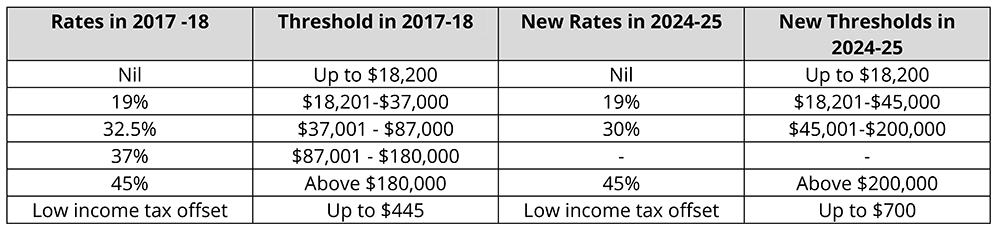

The new budget has brought forward new individual tax thresholds, implementing personal tax cuts for low to middle income earners. The lower tax rates will be brought forward from 1 July 2020 and be brought into effect in your 2020-21 fiscal year tax refunds.

- The top threshold for the 19% personal income tax bracket will be extended from $37,000 to $45,000

- The 32.5% personal income tax bracket between $37,000 – $87,000 will decrease to a 30% rate and will be for earners between $45,001 – $200,000

- The flat rate of 37% personal income tax rate for earners between $87,000 – $180,000 will be taken away

- Those earning above $200,000 will still incur a 45% personal income tax rate

Low Income Tax Offset

This year, if your taxable income was less than $66,667, you will receive the low income tax offset. Those who earn less than $37,000 will receive the full offset of $445. The Low Income Tax Offset will be increased from $445 to $700.

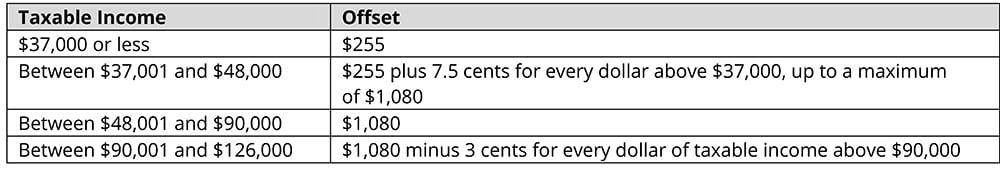

Low To Middle Income Tax Offset

The low and middle income tax offset amount is between $255 and $1,080. The amount you receive will vary depending on the amount you earn. Those who earn $37,000 or less will receive $255, while those income earners between $90,001 and $126,000 will receive $1,080 minus 3 cents for every dollar of taxable income above $90,000. The LITMO was due to be removed, however the new budget retains the LITMO offering individuals more of a tax break.

Download this article: New Budget 2020 What It Means For Australians

Exempting Granny Flat Arrangements from Capital Gains tax (CGT)

If you rent out all or part of your home, the income you receive is regarded as assessable income. This means that if you earn an income through renting all or part of your home, you might incur CGT when you sell your home.

New rules included in the budget will extend to Granny Flats rented to older people or people with a disability. The Federal Government will provide a targeted exemption on CGT for granny flat arrangements and apply to agreements that are entered into because of family relationships or personal ties and will not apply to commercial rental arrangement. This is likely to commence as early as 1 July 2020.

Tax Treatment of Disaster Recovery and Volunteer Fire-fighter Payments

2019-20 relief and recovery payments and benefits will be made to volunteer fire-fighters will be free from tax. The measure applies to the 2019-20 income year and later income years. This includes the Disaster Recovery Allowance and payments made by state and territory governments under the Disaster Recovery Funding Arrangements.

PHONE 1800 367 487 AND CHAT WITH ONE OF OUR FRIENDLY CONSULTANTS

Medicare Levy

The Medicare levy is 2% of your taxable income in addition to the tax you pay on your taxable income. Low income earners will benefit from an increased Medicare levy through exemption. The Government has increased the Medicare levy low-income thresholds for singles, families, and seniors and pensioners from the 2019-20 income year.

The threshold for singles has increased from $22,398 to $22,801. The family threshold has increased from $37,794 to $38,474. For single seniors and pensioners, the threshold has increased from $35,418 to $36,056. The family threshold for seniors and pensioners has increased from $49,304 to $50,191. For each dependent child or student, the family income thresholds increase by a further $3,533, instead of the previous amount of $3,471.

Social Security

The Federal Government will provide two separate $250 support payments to be made from November 2020 and early 2021 to eligible recipients of the following payments and health care card holders:

- Age Pension

- Disability Support Pension

- Carer Payment

- Family Tax Benefit, including Double Orphan Pension (not in receipt of a primary income support payment)

- Carer Allowance (not in receipt of a primary income support payment)

- Pensioner Concession Card (PCC) holders (not in receipt of a primary income support payment)

- Commonwealth Seniors Health Card holders

- eligible Veterans’ Affairs payment recipients and concession card holders.

These payments will be exempt from tax and will not count as support for the purpose on any income support payment.

CLICK HERE TO BOOK AN APPOINTMENT

Superannuation

Several reforms will be made to superannuation to improve the outcome of superannuation fund members. This ranges from funds that follow employees when they move jobs, simplification of to process to pay superannuation, tests on superannuation fund performance and transparency of fund trustee’s actions.

The ATO will allow increasing the maximum number of allowable members in self-managed superannuation finds and small APRA funds from four to six.

The Government has extended the application period for the $10,000 drawdown amount in 2020-2021 to 31 December 2020. There was no change to the legislated increase to the superannuation guarantee, which remains set to rise from 9.5 per cent to 12 per cent, with the first increase of 0.5 per cent due in July 2021.

Aged Care

The Federal Government will provide $2 billion over four years to support aged care by providing additional home care packages as well as striving to improve standards. An additional 23,000 home care packages across all package levels will be increased. Those Australian previously not eligible for the National Disability Insurance Scheme will receive the supports they need in the form of $125.3 million over three years from 2020-21.

A Business Improvement Fund is planned to provide eligible aged care providers $35.6 million over two years to improve their financial operations. Reforms also include a new serious incident response scheme, an enhanced My Aged Care system, delaying of payment in arrears and on invoice for home care services, additional funding for dementia services and training programs, and a network of care providers and finding to allow people to stay in their own homes longer.

ITP The Income Tax Professionals have helped Australian Individuals with their tax and finances for 50+ years. We’re always on top of changes made through the ATO and both Federal and State Governments. There’s no doubt this latest budget will affect many Australians. If you’re wondering how these change affect you, our friendly consultant are free to chat. Phone 1800 367 487 today.

Whilst taking every precaution to stay safe, our Tax Accountants are available during normal business hours to help with any enquiry. Speak with a Professional and see how they can help you today.

Call 1800 367 487, or book online at www.itp.com.au and your tax agent will be in touch to help.