If you ever need to travel as part of your employment or in the course of operating your business, you may have some claimable deductions waiting for you come tax time. Whether you receive a travel allowance, are fully funded, or pay all the work-related travel expenses yourself, there are likely some legitimate tax deductions you can claim. So, if you’re keen to lower your tax burden, read on to ensure you’re making the most of your travel costs.

What Are Work-Related Travel Expenses?

If you’re out of pocket when you travel for work, common expenses you may claim include:

- Airline, bus, trains, tram, taxi fares, and any ride-sourcing fares

- Car hire plus associated fees, fuel costs, road tolls, and car parking fees

- Accommodation

- Meals if you stay away from home overnight

Pro Tax Tip: If you’ve had to purchase a suitcase, bag, or laptop case for your travel, keep those receipts. That expense is a valid claim. Not confident with your record-keeping system? We’ve got you! Check out our guide to keeping tax records to maximise your deductions.

Claiming Travel Expenses

Travel could be your main expense. This includes whether you’ve incurred costs for daily travel, travel taken overnight or many nights, or an overseas trip. Your travel could simply be going from your workplace to a conference or seminar, or travelling to a client’s residence for a meeting. You can even claim the expenses of travelling from one office location to another on the same day.

Just keep in mind that there are a few instances where you can’t claim travel expenses:

- To claim overnight costs, you must have a permanent residence elsewhere. You can’t claim costs if you’re moving to live in another location;

- You can’t claim travel to and from your home to your workplace, except under very specific circumstances. Check with your tax accountant to see if your circumstances pass the test;

- You can’t claim running a personal errand to and from the office;

- You can’t claim travel expenses if you’ve worked overtime or out of hours;

- You can’t claim travel costs if you’ve been reimbursed by your employer or had free use of facilities provided by your employer.

Click here to read how to claim car expenses

CHAT WITH A FRIENDLY ITP TAX ACCOUNTANT TODAY

What Is Overnight Travel?

The Australian Taxation Office (ATO) considers it overnight travel if you are away from your home and need to stay overnight at a place that is not normally a residence of yours. This type of travel applies when the normal place where you work and perform your duties hasn’t changed location, and you stay for a short term in a hotel or similar.

To claim overnight travel as a business expense, you can’t travel with your family or friends, nor can you claim overnight travel for any personal reason such as wanting to be closer to a workplace or living at another location while working.

The types of overnight travel expenses you may claim include:

- Accommodation – the cost of staying at a hotel, motel, serviced apartment, caravan, or booking on platforms like Airbnb

- Transport expenses to and from the location

- Charges for phone and internet

- Meals and drinks

- Car parking fees

- Bus tickets

How to Keep a Travel Diary

When it comes to claiming work-related travel expenses, the more documentation you can provide, the better. Just as you need to keep a log book to claim car expenses, you should keep a travel diary to document your travel expenses.

Here are the key points you’ll need to include:

- The name of the place where the business activity occurred

- The date and time the business activity began and ended

- A description of your business activity

- How long the activity lasted

Pro Tax Tip: If your business activity was a mix of personal and business, you’ll need to apportion and claim only the business costs. If this sounds like more complexity than you’re willing to take on, contact your nearest ITP branch. One of our skilled tax accountants can handle all the complex calculations for you, maximising your deductions without the stress and hassle.

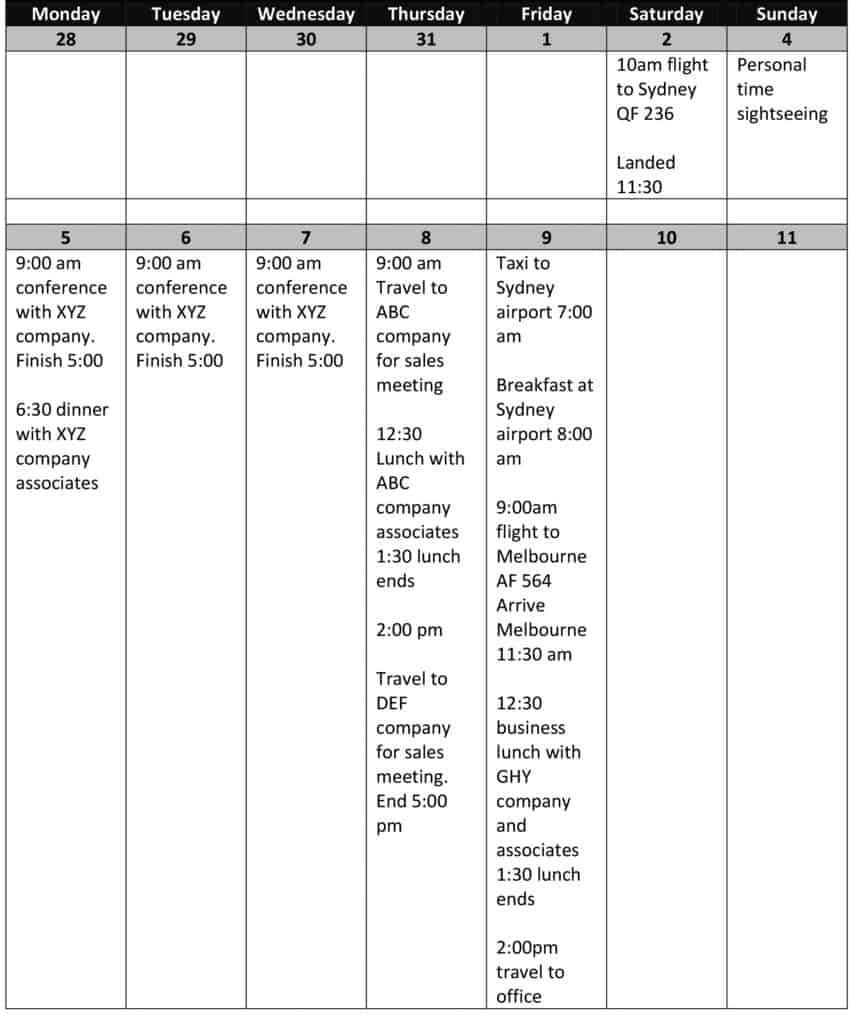

Travel Diary Example

Pro Tax Tip: As a business owner, if you’re entitled to input tax credits under GST, you can claim a tax deduction in your income tax return of the GST-exclusive amount.

Are Travel Allowances Taxable?

If you receive a travel allowance, you’ll need to add that to your taxable income. The amount should show up on your income statement when you lodge your tax return. If it doesn’t show up, you’ll need to add it manually. You’ll then claim back whatever money you’ve spent on work-related travel expenses at tax time.

Pro Tax Tip: Since it’s added to your taxable income and is seen as an income stream, you can’t claim the entire allowance as a tax deduction. Instead, you can only claim your allowable expenses.

How to Record Travel Expenses

You can only claim expenses that you’ve already incurred, that you’re personally out-of-pocket for, and that you can prove you’ve incurred the expense. As well as a travel diary, the ATO will expect other forms of proof. This could be in the form of receipts, tax invoices, contracts, and other financial reports. You can’t claim a travel expense unless you can prove it, so it’s vital that you dial in your record-keeping system.

You can keep electronic evidence as long as it’s a clear and true representation of the original. Don’t forget to keep a backup folder in case your electronic files are lost or corrupted.

You want to claim all the travel expenses you can. After all, the difference could mean hundreds if not thousands of dollars in your tax return. Need a little help negotiating your travel expenses? After spending more than 50+ years helping Australians lodge their tax returns, there’s not a lot ITP’s Accounting Professionals don’t know about tax. Even better, our fees are fully tax deductible. Phone 1800 367 487 to chat with a friendly professional today.