When your business earns over $75,000 in gross income, you will be required to collect GST and fill out a BAS statement. As a part of this legal requirement, you will need to issue a tax invoice to your customers, so that they know the GST component of their bill, and in turn the GST credits they can claim back.

To be legally compliant, your tax invoice of sales more than $82.50 (including GST) will need to contain at least seven pieces of information. If a customer asks you for a tax invoice you must provide one within 28 days of their request.

What do you need to include in your tax invoice?

There are different requirements for tax invoice amounts below and over $1,000. You’ll need to be aware of the information that needs to be included to be legally compliant.

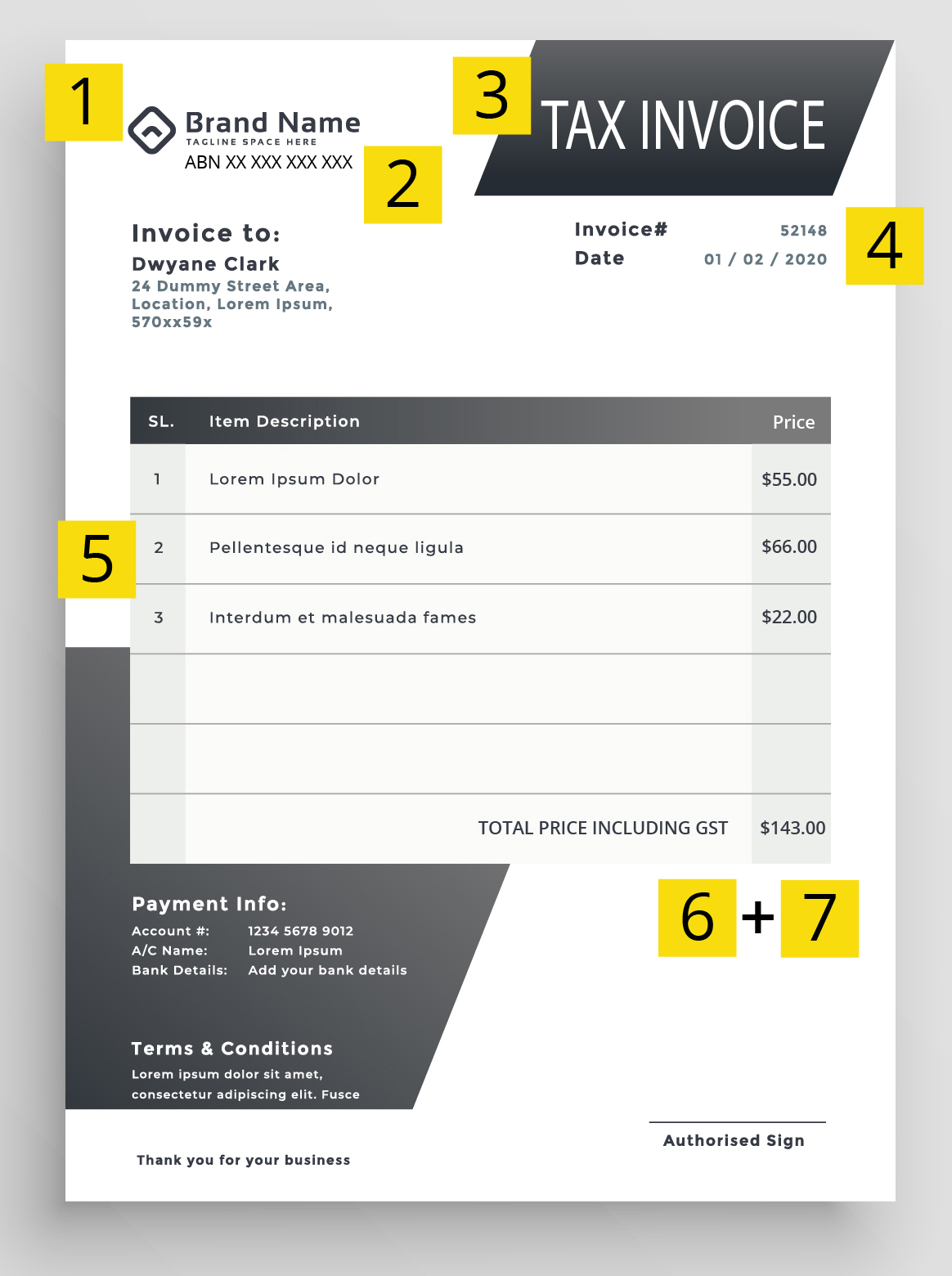

Tax Invoices of less than $1,000

You must include enough information to clearly determine the following seven details:

- Name of your business

- ABN number

- Tax invoice clearly stated

- Date

- Itemised goods or services provided

- Total price including GST

- The extent to which the invoice is a taxable sale

The example below shows the requirements of seven elements. The sale is clearly identified as being fully taxable using the words ‘Total price including GST’.

NEED SOME HELP? ITP OFFER BOOKKEEPING SERVICE TAILORED TO SUIT YOUR BUSINESS.

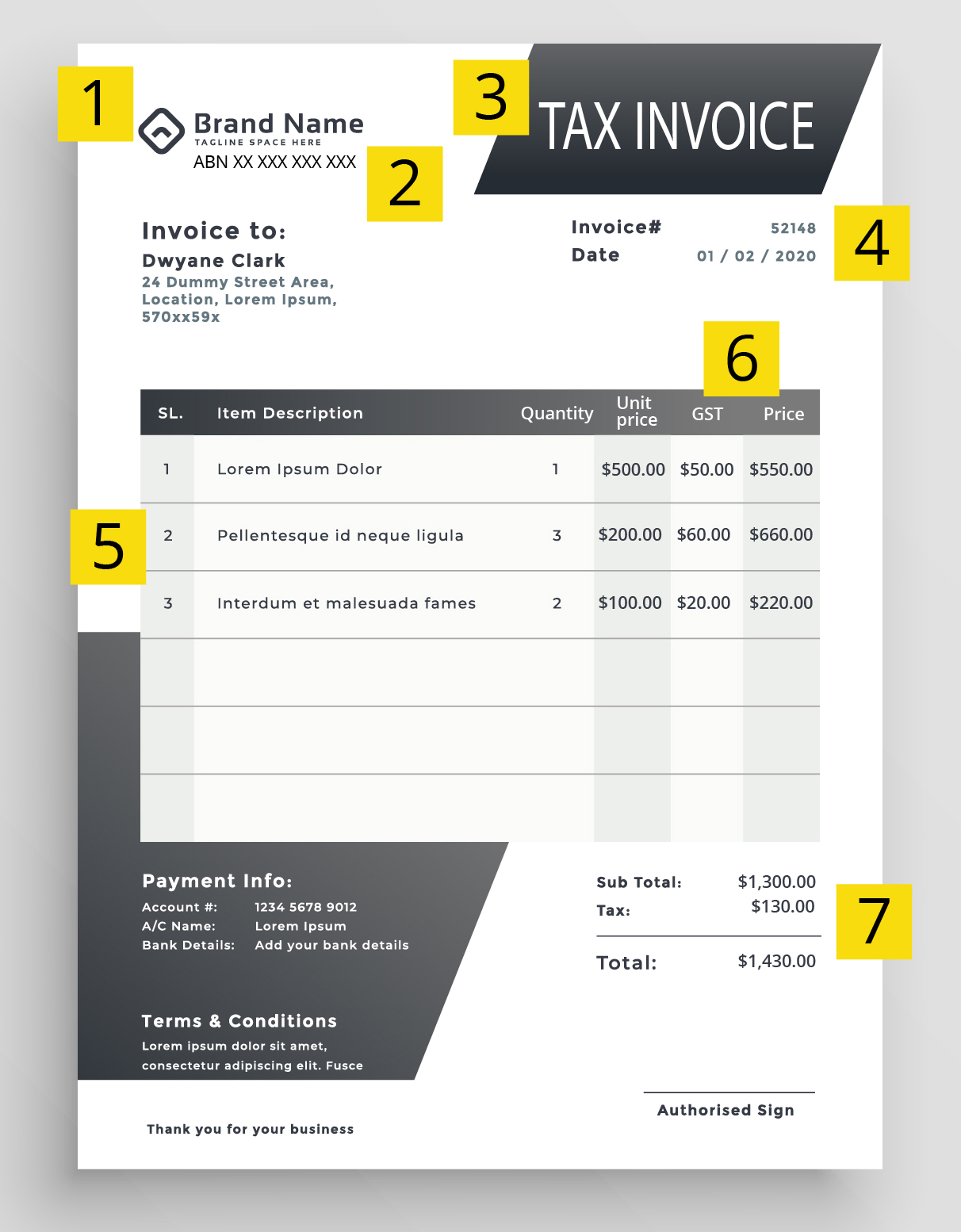

Tax Invoices of more than $1,000

The example blow clearly shows the GST included in each column beneath the labelled column.

- Name of your business

- ABN number

- Tax invoice clearly stated

- Date

- Itemised goods or services provided

- GST component of price

- Total price which clearly shows the overall GST paid

Download this article: What is a valid GST tax invoice

Pro Tax Tip: You don’t need to supply your tax invoice in paper form. You can issue an invoice to a customer via electronic means.

You can provide a tax invoice that includes taxable and non-taxable items that are GST free or input-taxed. You must clearly state which items are taxable, as well as show each taxable sale, the amount of GST to be paid and that total amount to be paid.

There’s no need to be overwhelmed. ITP The Income Tax Professionals help Australian business with their bookkeeping and business accounting needs. Whether it’s one day a week or five, we tailor our service to suit your unique needs. Call a Professional today to discuss how we can help.