Many countries have a goods and services tax. In Australia it is a broad-base, indirect flat rate tax of 10% payable on most goods and services sold or consumed in Australia. The end-user in a commercial chain of transactions incurs the cost of the GST.

There are some exemptions (such as for certain food, healthcare and housing items) and concessions (including qualifying long term accommodation which is taxed at an effective rate of 5.5%)

Businesses collect GST for the government whenever they sell goods and services and pay this revenue to the Australian Tax Office (ATO). GST is levied on most transactions during the production process, but is refunded to all parties in the chain of production other than the final consumer.

What does collecting GST mean for my business?

If your business is registered for GST, you must charge your customers an extra 10% of the goods and services you sell. You will be entitled to claim back a credit for any GST paid for any expenses incurred to provide those goods and services (called input tax credits). Your business will also be obligated to lodge a Business Activity Statement (BAS) on a monthly, quarterly and annual basis. This is done at the same time the net amount of GST owed to the tax office.

When do I need to register for GST?

You must register for GST if:

- Your annual business income is $75,000 or more a year, or $150,000 or more for not-for-profit organisations.

- You provide taxi travel (transporting passengers by taxi or limousine for a fare) as part of your business.

- You want to claim fuel tax credits.

If your annual business income is less than $75,000 (or $150,000 for not-for-profit organisations), you don’t need to register for GST, but you can do so if you choose.

Once you’re registered for GST, you can claim back the GST you pay on the goods and services you buy for your business (so long as you have a tax invoice from the supplier).

Click here to make an appointment with an ITP Tax Accountant

How do I register for GST?

You are able to register your business online, by phone or via a registered tax or BAS agent. To register, you will need your Australian Business Number (ABN) and register for GST within 21 days of your GST turnover if you reach the $75,000 annual gross income threshold. You will also need to know your business structure as that will impact how your business pays tax and claim assets.

What happens after I register for GST?

You will now be required to collect GST as a part of your transactions with your customers and will need to charge your customers an extra 10% on your goods or services. You will be able to claim credits for GST included in the price of goods and services you buy for your business. Businesses that collect GST will need to fill out a BAS on an annual, quarterly or monthly basis and send the amount collected to the ATO.

How do I calculate GST?

You’ll need to add an extra 10% to your invoice. Simply multiply your invoice by 1.1%. You’ll need to issue a tax invoice. This is important because it tells people how much GST they have paid, and if they are eligible, they can claim back the GST.

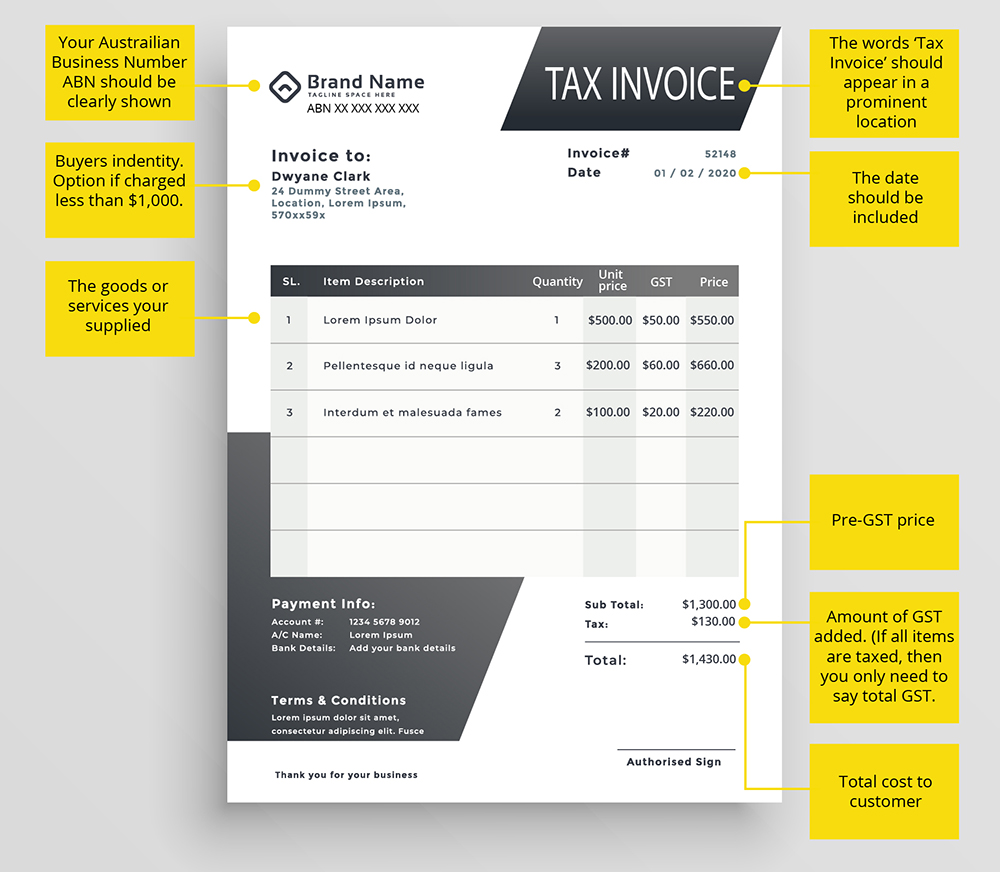

Here’s what you need to put on a tax invoice.

Download this article: What is the Goods and Services Tax

When do I make GST payments to the ATO?

Your GST reporting and payment cycle will be one of the following:

- Monthly – if your GST turnover is $20 million or more.

- Quarterly – if your GST turnover is less than $20 million – and we have not told you that you must report monthly.

- Annually – if you are voluntarily registered for GST. That is, you are registered for GST; and your GST turnover is under $75,000 ($150,000 for not-for-profit bodies).

Depending on your circumstances, you can change the cycle you use to report and pay GST. This may happen when your GST turnover changes or if you choose to report and pay using a different cycle.

How do I pay the GST to the ATO?

You can pay the ATO through many methods:

- Credit card

- Direct transfer / debit

- In person at Australia Post

- Overseas transfer

- Through your registered tax or BAS agent, accountant or bookkeeper

You need to use your unique Payment Reference Number (PRN) every time you make a payment which guarantees your money goes to the right account and that it is registered that you have paid.

What products or services are exempt from GST?

Most basic foods, some education courses, and some medical, health and care products are exempt from GST. If you’re unsure if you need to charge GST speak to your business activity statement (BAS) agent or accountant.

Are exports exempt from GST?

Exports of goods from Australia are generally GST-free, if they’re exported from Australia within 60 days of the supplier issuing an invoice for the goods or receiving any payment for those goods.

Exports of services are usually GST-free if the recipient of that service is outside Australia.

There are rules to determine whether an export sale is GST-free. Speak with your accountant regarding your specific circumstances.

Taking care of business

ITP The Income Tax Professionals help businesses around Australia with their tax and accounting requirements. With over 210 locations, there’s sure to be a branch near you. If one isn’t close by, ITP have a remote service and can help you wherever you are in Australia. Call a professional today and see how they can help you.