Covid-19 packages have flowed into the economy to help businesses and individuals since March 2020 in a bid to keep the economy running. One of the first measures introduced, were two $750 cash payments given to people who already received a range of benefits. The first supplementary payment of $750 was made to eligible individuals who were already on JobSeeker, the Age Pension or Disability Support Pension between March 12 and April 13 this year. Most of these individuals received their $750 by April 17 with more than $4.5 billion automatically paid to 6.6 million people. Those who made a claim and were approved will also receive the payment when the claim has been processed.

The second payment is now due to be paid.

This second round of payment is set to be paid to around 5 million Australian at a cost of $3.8 billion.

Individuals who are eligible will receive the second payment from July 13. A person can be eligible to receive both the first and second support payment. However, they can only receive one $750 payment in each round of payments, even if they qualify for the payments in multiple ways.

Who is eligible for the second payment?

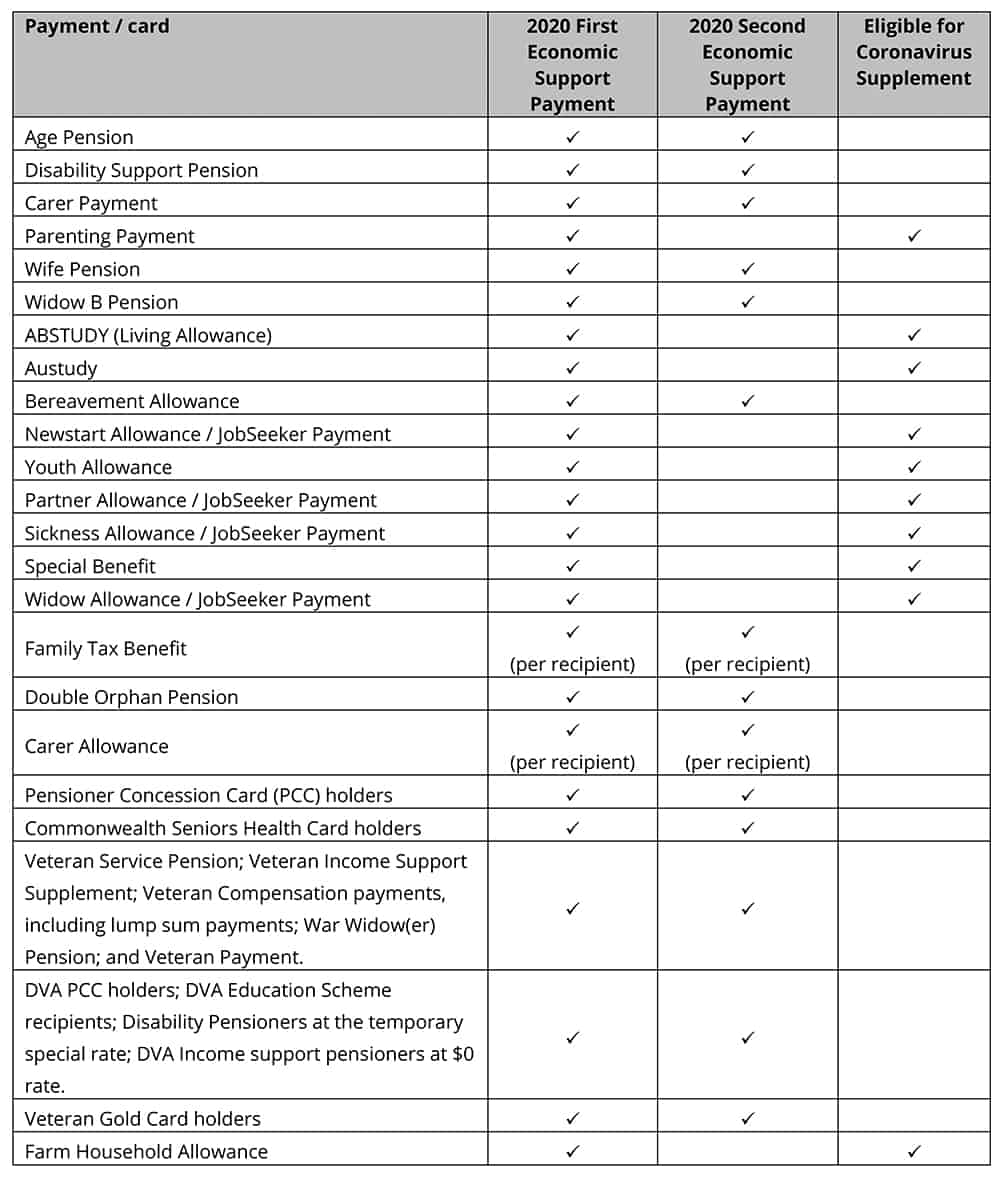

The second payment is expected to be made to individuals who receive social security or veteran payments, those who receive other income support, as well as eligible concession card holders.

To be eligible for the second round of $750 payment, you should be residing in Australia and already be receiving:

- JobSeeker Payment (and payments progressively transitioning into JobSeeker Payment; those currently receiving Partner Allowance, Widow Allowance, Sickness Allowance and Wife Pension)

- Youth Allowance

- Parenting Payment (Partnered and Single)

- Austudy

- ABSTUDY (Living Allowance)

- Farm Household Allowance

- Special Benefit

Individuals who receive Family Tax Benefit A and B, as well as those who hold a Commonwealth Seniors Health Card or a Pensioner Concession Card will receive the payment. If an individual received support through more than one scheme, the $750 will not be paid twice. Also those who are eligible for the Coronavirus Supplement of an extra $550 per fortnight in their benefits, will not qualify for the $750 payment.

Those on Youth Allowance and JobSeeker were given the first $750 payment and are not eligible for the second round of support.

Payments will be made by Services Australia or the Department of Veterans’ Affairs. If you are a holder of a Veteran Gold Card, Services Australia will contact you to confirm your account details so the payment can be made as soon as possible.

Benefits eligible for economic support payments

When will individuals receive the payment?

Individuals who are eligible will receive the $750 supplement automatically in their bank accounts this week, but it will take until the end of the month for some others to receive their supplement.

Families who receive the Family Tax Benefit (FTB) will receive their payments depending on how they receive their FTB. If the benefit is received fortnightly, the $750 will be paid from July 15. If the family has chosen to be paid at the end of the financial year the first $750 will be paid when they lodge their 2019-2020 tax return. The second $750 payment will be paid after the end of the 2020-21 financial year upon finalisation of the tax return, which might not be until July 2021.

How Does This Impact My Tax Return?

The payments will not be taxed and will not count as income for the purposes of Social Security, Farm Household Allowance and Veteran payments. You will need to include the payment when you lodge your tax return.

The $550 per fortnightly payments ARE taxed. Most government benefits are taxable income. Government payments such as the age pension, carer payments, Austudy, JobSeeker Payment, Newstart and Youth Allowance must be declared on your tax return. The extra $550 payment is not considered to be a supplement, but is considered to be a higher rate of the JobSeeker payment.

Some government payments are exempt from tax, but you still need to declare it. This is to work out if you’re eligible to receive a range of other government benefits and tax offsets.

The tax-free threshold is $18,200. If you’ve had tax taken out from your JobSeeker payments or other government payments and are below the tax-free threshold, you will get a tax refund on tax paid when you lodge your tax return. If you earn over $18,200 in total, you will be required to pay tax at the normal tax rate, which start at 19% for those who earn between $18,200 and $37,000.

Download this article: Will You Get The Extra $750 In Your Account

What if I cannot work and have contracted Covid-19?

Those who have contracted Covid-19 and cannot work due to isolation should call Services Australia and can be granted a Major Personal Crisis exemption for 14 days, without having to provide evidence such as a medical certificate (however, any requests to extend the 14 days will require evidence, such as a medical certificate). Those over the age of 22 and under the Age Pension qualification age who have contracted Covid-19 and cannot work due to isolation may qualify for Sickness Allowance if they do not have any employer leave entitlements and meet the eligibility tests.

From 20 March 2020, Sickness Allowance will close to new entrants and be replaced by the JobSeeker Payment. Young people under the age of 22 who are unable to attend work because they have been diagnosed with the Coronavirus or who are in isolation may qualify for Youth Allowance if they do not have any employer leave entitlements and meet eligibility tests. Contact Services Australia if you think you quality for payments and are not receiving them.

An ITP Tax Accountant understands how the federal government schemes affect your tax, and will help you when it comes time to lodge your tax return. ITP Tax Accountants have helped Australian individuals and businesses for 50+ years. If you have any questions about the government packages, an ITP Tax Accountant will be able to help.

Whilst taking every precaution to stay safe, our Tax Accountants are available during normal business hours to help with any enquiry. Speak with a Professional and see how they can help you today.

Call 1800 367 487, or book online at www.itp.com.au and your tax agent will be in touch to help.